[Job Market Update] 2022 Q4 ENG

2022 - Q3 Job Market in South Korea

Economy, Labor Market Summary

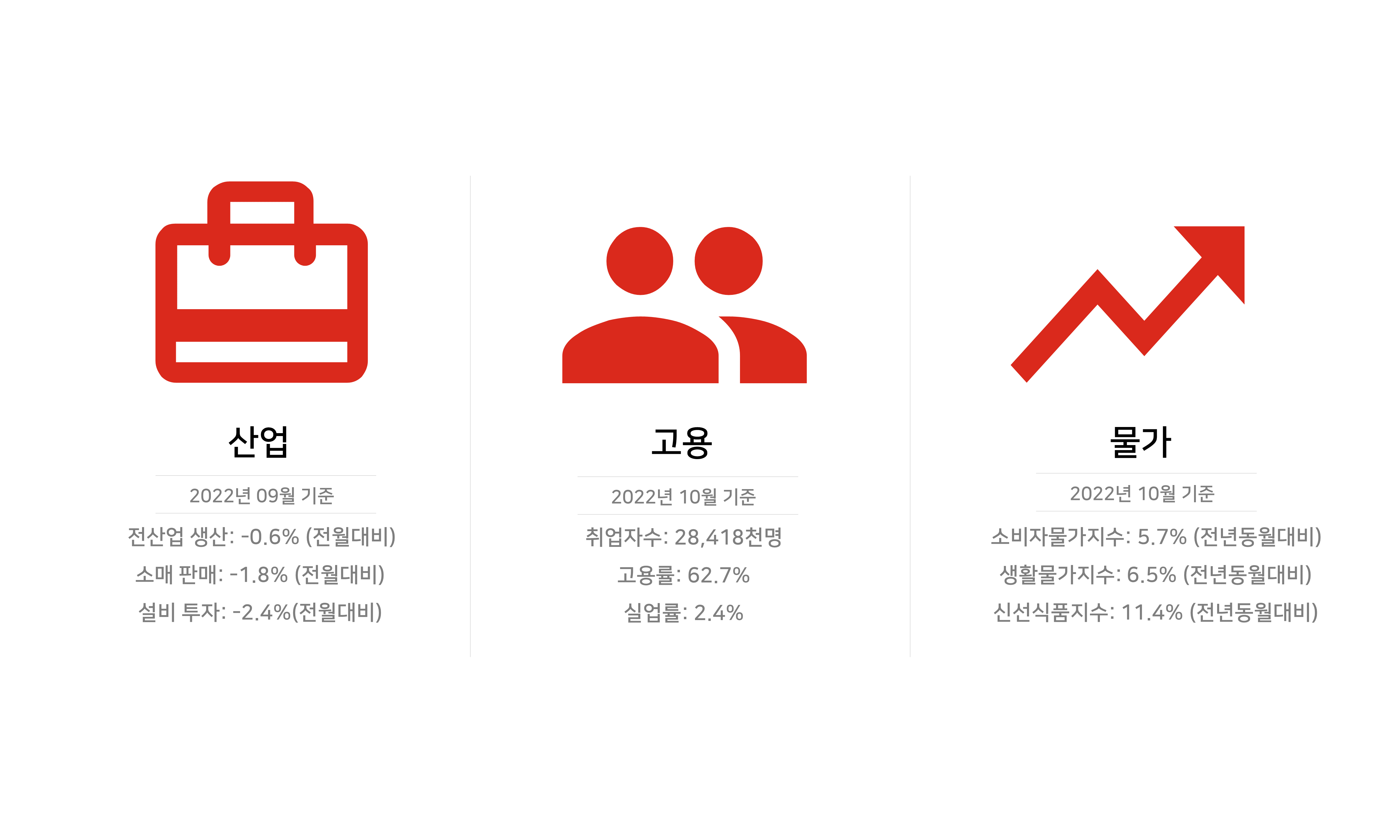

According to Bank of Korea, South Korea's economy expanded 0.3% quarter-on-quarter in the three months to September 2022, growing at the slowest pace in a year as households and businesses held back on spending amid concerns about higher costs and rising interest rates. The latest statistics from Statistics Korea [hereinafter referred to as KOSTAT] indicated that the country's economically active population marked 29.110 million persons in October, which grew 582 thousand persons or 2.0% year-on-year, and the labor force participation rate stood at 64.3% in October, up 1.1% year-on-year, although it dropped from the high of 64.9% in June of Q2 to 64.2% in September of Q3.

As for main economic indicators, the business cycle clocks displayed below for July through September presented by KOrean Statistical Information Service [hereinafter referred to as KOSIS] clearly show that Services, Equipment Investment, Value of Construction Completed, and Imports are located in the expansion phase (green quadrant), while Consumer Expectation Index is located in the recovery phase (yellow quadrant), Employed Persons in the slowdown phase (orange quadrant), and Industrial Production, Exports, Business Survey Index (BSI), and Consumer Expectation Index all in the recession phase (Red quadrant).

In comparison with July's and August's clocks, Services, Retail Sales, Equipment Investment, Value of Construction Completed, and Imports are increased in September while Industrial Production, Exports, Employed Persons, Business Survey Index (BSI), and Consumer Expectation Index are decreased.

Among those indicators in the recession phase, preliminary data showed that exports from South Korea shrank 5.7% year-on-year to $52.48 billion in October, shifting from a 2.7% rise in September and worse than market estimates of a 3% fall. This was the first drop in shipments since October 2020 amid deteriorating foreign demand as inflation pressures persist globally. Sales of semiconductors slid 17.4% year-on-year, due to waning demand and a fall in chip prices.

Well-controlled Inflation Backs Export Momentum While Lost Value of Won Threatens Consumption

Despite the seemingly worrisome figures on export stated above, Bryan JP, Adecco's South Korea country manager, maintains that South Korea's economy, which relies heavily on export, has fared consistently in Q3, with GDP set to grow slowly at 2% to 2.5%, depending on how the final quarter closes. Export and internal consumption remained the top two factors that affected South Korea's job market in the third quarter, according to Bryan, who adds that thanks to the continuous US demand in semiconductors and all that related to it, not-full-yet impact from the Russia-Ukraine war, and relatively well-maintained one-digit inflation, South Korea still saw robust exports in Q3. However, the lost value of the South Korean won has obviously exerted pressure on consumers and slowed down local economic recovery post COVID-19.

Bidding War for Tech-Skill Roles; Startups Struggling for Survival

As for workforce demand and supply in the third quarter, Bryan cites logistics, healthcare, and technology as some of the flourishing sectors during the pandemic. For logistics, he notes that despite its continuous growth, the sector encountered "real difficulties in term of talent attraction because of its highly labor intensive nature and less and less people want to do those jobs." On the tech side, on the other hand, Bryan says whether it is traditional semiconductor or new tech fields such as AI and auto driving, whether it is software engineering, development, or data, tech skills are highly desired for specific job functions, and the positions of engineers and developers have been in great demand as it takes time to cultivate a workforce for the jobs. He also points out that the energy sector remains solid even with the change of administration.

Ben Holderness, head of expansion at General Assembly, a global tech up/reskilling company advancing the future of work as part of digital transformation, echoes Ben by naming software engineers, developers, and data scientists as the job roles that are still in shortage across the board. Profession-wise, e-commerce, gaming, and specialist companies that would be focusing on robotics or automation are in the rank of increasing popularity and therefore "there is a bit of a bidding war going on for the best candidates," says Ben.

However, Both Bryan and Ben note that some startups in fintech or other functions, which usually boast of technology-related niche, have been struggling due to financial challenges in the market. "A lot of the startups have been actually burning through the money or failed to survive," according to Bryan. "So that sends worry of waves through the market and candidates know that it is now very hard to raise money in South Korea for startups, and as a result, they stay away from the companies," Ben concludes.

Commenting on other challenges in hiring in general, Bryan shares his view from the recruiter's perspective that a "reeducation" process would be needed to bridge the disconnection caused by the pandemic when job seekers and headhunters were forced to engage virtually and then became used to meeting online. "So we educated our people to work online and now we are trying to reeducate the market to work offline again," Bryan says, sounding amused.

Ben, from the employer's perspective, holds that companies need to offer more flexible arrangements now than before as candidates are likely to take into deeper consideration work mode flexibility and people-oriented corporate culture. For example, companies with order and hierarchy-based systems and top-down command and control might need to build different cultures as they do not seem appealing to most candidates nowadays.

Industry Outlook for Job Seekers

Looking forward to the next quarter, Bryan says that the Yoon [Suk-yeol] administration, on top of what happened over the Halloween weekend, is having a lot of uncertainty to deal with, which also involves risks from other countries globally, primarily the United States and China. "I do not think the government is the pilot on the plane; it is more of a copilot while the pilot is international environment," comments Bryan. Expounding on how highly dependable South Korea is on the US and China in particular, Bryan adds that it is the US plus China plus Russia who can call the shots, that they will collectively influence the South Korean Government's decision-making in the upcoming months, and that the Q4 outlook will also hinge upon how a potential recession in these powers will play out.

As for which sectors will become more proactive in terms of employee recruitment in Q4 of 2022 and 2023, Larry, head of the general staffing sector of Adecco's South Korean Office, expects to see recovery of potential consumption and needs in 2023, with positions of sales promoters as well as in the customer service sector opening up again actively. Larry adds that certain major tourism platform companies already requested mass recruiting (+100 hires) in Q4 to cope with surging customer service needs.

Commenting on the ongoing trend of temporary workers and contractors employment, Larry says that many companies are now hiring on shorter-term contract basis around six months instead of over one year because the managements have experienced the uncertainty of the market and are now seeking more flexibility in those business and recruitment plan.

Statistics also show that temp/contract workers (so called non-regular workers) have increased 28.3% year-on-year (OECD standard), a number higher than that of other major countries, for example, 15% in Japan. Meanwhile, various types of job market players (gig economy, freelancers, part-time workers) also contribute to the trend of increment of contractors who voluntarily choose to work flexible hours.

Asked how companies and job seekers should respond to changes in the general environment and job market, Ben suggests that companies should adopt a new approach in line with the rest of the world on hiring people based on their skills but not on the schools they graduated from. He cites major companies such as Amazon as saying they would run boot camps and then hire people at the end of the programs to ensure the candidates have acquired the desired skill set for their jobs. "So that is what we are doing in General Assembly. Basically, it is reskilling and upskilling."

Bryan, on the other hand, addresses the issue from job seekers' perspective. He says that "current job seekers actually have the blessing of time in South Korea because in five years' time, there will be a big shortage of workforce in the market." Bryan advises that young-generation candidates, students, and fresh graduates should find jobs that are going to position themselves for the future instead of being obsessed with getting a perfect job right away. Bryan continues to say that taking a job that puts you on the right path can later on get you to the party where you can navigate once you are inside. "Do not stay outside of the door just because it is not exactly the party you wanted in the first place."